You are looking for information, articles, knowledge about the topic nail salons open on sunday near me interview intel pat gelsinger idm tsmc on Google, you do not find the information you need! Here are the best content compiled and compiled by the toplist.prairiehousefreeman.com team, along with other related topics such as: interview intel pat gelsinger idm tsmc intel pat gelsinger announcement, stratechery, intel foundry capacity, intel expansion, stratechery passport, intel external manufacturing, intel foundry services, intel future plans

An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, and learning from AMD’s success (Ben Thompson/Stratechery) – UN STORE

- Article author: unstore.com.np

- Reviews from users: 45097

Ratings

- Top rated: 3.9

- Lowest rated: 1

- Summary of article content: Articles about An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, and learning from AMD’s success (Ben Thompson/Stratechery) – UN STORE An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, … …

- Most searched keywords: Whether you are looking for An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, and learning from AMD’s success (Ben Thompson/Stratechery) – UN STORE An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, … Source link

- Table of Contents:

An Interview with Intel CEO Pat Gelsinger – Stratechery by Ben Thompson

- Article author: stratechery.com

- Reviews from users: 27892

Ratings

- Top rated: 3.2

- Lowest rated: 1

- Summary of article content: Articles about An Interview with Intel CEO Pat Gelsinger – Stratechery by Ben Thompson I got a chance to talk to Gelsinger earlier this week about IDM 2.0 … or be part of the Big Three, I’ll call it Samsung, TSMC and Intel on … …

- Most searched keywords: Whether you are looking for An Interview with Intel CEO Pat Gelsinger – Stratechery by Ben Thompson I got a chance to talk to Gelsinger earlier this week about IDM 2.0 … or be part of the Big Three, I’ll call it Samsung, TSMC and Intel on …

- Table of Contents:

Page Not Found – Electronics Technology

- Article author: electronicstechnology.in

- Reviews from users: 29609

Ratings

- Top rated: 3.9

- Lowest rated: 1

- Summary of article content: Articles about Page Not Found – Electronics Technology Technology. An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, and learning … …

- Most searched keywords: Whether you are looking for Page Not Found – Electronics Technology Technology. An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, and learning …

- Table of Contents:

An Interview With Intel CEO Pat Gelsinger About His IDM 2.0 Strategy, Partnering With TSMC, The Tower Semiconductor Acquisition, And Learning From AMD’s Success (Ben Thompson/Stratechery) | DigiplaceX

- Article author: digiplacex.com

- Reviews from users: 2966

Ratings

- Top rated: 4.3

- Lowest rated: 1

- Summary of article content: Articles about An Interview With Intel CEO Pat Gelsinger About His IDM 2.0 Strategy, Partnering With TSMC, The Tower Semiconductor Acquisition, And Learning From AMD’s Success (Ben Thompson/Stratechery) | DigiplaceX An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, and learning from AMD’s … …

- Most searched keywords: Whether you are looking for An Interview With Intel CEO Pat Gelsinger About His IDM 2.0 Strategy, Partnering With TSMC, The Tower Semiconductor Acquisition, And Learning From AMD’s Success (Ben Thompson/Stratechery) | DigiplaceX An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, and learning from AMD’s … Source link

- Table of Contents:

An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, and learning from AMD’s success (Ben Thompson/Stratechery)

- Article author: fixlaptop.com.au

- Reviews from users: 44257

Ratings

- Top rated: 3.0

- Lowest rated: 1

- Summary of article content: Articles about An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, and learning from AMD’s success (Ben Thompson/Stratechery) Ben Thompson / Stratechery: An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, … …

- Most searched keywords: Whether you are looking for An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, and learning from AMD’s success (Ben Thompson/Stratechery) Ben Thompson / Stratechery: An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, … Ben Thompson / Stratechery: An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, and learning from AMD’s success — Intel has been one of the companies I have focused on from the very beginning of Stratechery. Source link

- Table of Contents:

An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, and learning from AMD’s success (Ben Thompson/Stratechery)

- Article author: geniusinteractive.org

- Reviews from users: 48265

Ratings

- Top rated: 4.6

- Lowest rated: 1

- Summary of article content: Articles about An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, and learning from AMD’s success (Ben Thompson/Stratechery) An interview with Intel CEO Pat Gelsinger about his IDM 2.0 technique, partnering with TSMC, the Tower Semiconductor acquisition, and studying from AMD’s … …

- Most searched keywords: Whether you are looking for An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, and learning from AMD’s success (Ben Thompson/Stratechery) An interview with Intel CEO Pat Gelsinger about his IDM 2.0 technique, partnering with TSMC, the Tower Semiconductor acquisition, and studying from AMD’s … Ben Thompson / Stratechery: An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, and learning from AMD’s success — Intel has been one of the companies I have focused on from the very beginning of Stratechery. Source link

- Table of Contents:

An interview with Intel CEO Pat Gelsinger about his IDM 2.0 technique, partnering with TSMC, the Tower Semiconductor acquisition, and finding out from AMD’s luck (Ben Thompson/Stratechery) » My Cyber Base || Billions of Free and paid data.

- Article author: mycyberbase.com

- Reviews from users: 48634

Ratings

- Top rated: 3.2

- Lowest rated: 1

- Summary of article content: Articles about An interview with Intel CEO Pat Gelsinger about his IDM 2.0 technique, partnering with TSMC, the Tower Semiconductor acquisition, and finding out from AMD’s luck (Ben Thompson/Stratechery) » My Cyber Base || Billions of Free and paid data. An interview with Intel CEO Pat Gelsinger about his IDM 2.0 technique, partnering with TSMC, the Tower Semiconductor acquisition, and finding out from AMD’s … …

- Most searched keywords: Whether you are looking for An interview with Intel CEO Pat Gelsinger about his IDM 2.0 technique, partnering with TSMC, the Tower Semiconductor acquisition, and finding out from AMD’s luck (Ben Thompson/Stratechery) » My Cyber Base || Billions of Free and paid data. An interview with Intel CEO Pat Gelsinger about his IDM 2.0 technique, partnering with TSMC, the Tower Semiconductor acquisition, and finding out from AMD’s … My Cyber Base || Billions of Free and paid data. My Cyber Base Provide various kind Billion of Data. You can download and share all of them to your friend and family.

- Table of Contents:

An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, acquiring Tower Semiconductor, and learning from AMD’s success (Ben Thompson / Stratechery) – News5s

- Article author: news5s.com

- Reviews from users: 31157

Ratings

- Top rated: 4.5

- Lowest rated: 1

- Summary of article content: Articles about An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, acquiring Tower Semiconductor, and learning from AMD’s success (Ben Thompson / Stratechery) – News5s An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, acquiring Tower Semiconductor, and learning from AMD’s success … …

- Most searched keywords: Whether you are looking for An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, acquiring Tower Semiconductor, and learning from AMD’s success (Ben Thompson / Stratechery) – News5s An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, acquiring Tower Semiconductor, and learning from AMD’s success … Source link

- Table of Contents:

An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, and learning from AMD’s success (Ben Thompson/Stratechery) – The News Talks

- Article author: thenewstalks.com

- Reviews from users: 8399

Ratings

- Top rated: 4.1

- Lowest rated: 1

- Summary of article content: Articles about An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, and learning from AMD’s success (Ben Thompson/Stratechery) – The News Talks Ben Thompson / Stratechery: An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor. …

- Most searched keywords: Whether you are looking for An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor acquisition, and learning from AMD’s success (Ben Thompson/Stratechery) – The News Talks Ben Thompson / Stratechery: An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor. Ben Thompson / Stratechery: An interview with Intel CEO Pat Gelsinger about his IDM 2.0 strategy, partnering with TSMC, the Tower Semiconductor

- Table of Contents:

Latest

Latest

Latest

Latest

Latest

Latest stories

What’s Your Reaction

You May Also Like

GAMETALKS

Trending

See more articles in the same category here: https://toplist.prairiehousefreeman.com/blog.

An Interview with Intel CEO Pat Gelsinger

Good morning,

Intel has been one of the companies I have focused on from the very beginning of Stratechery. Back then Intel was the unquestioned leader in advanced chip manufacturing, and I urged the company to build a foundry business; then the company lost its leadership position to TSMC, even as TSMC’s dominance raised significant geopolitical concerns.

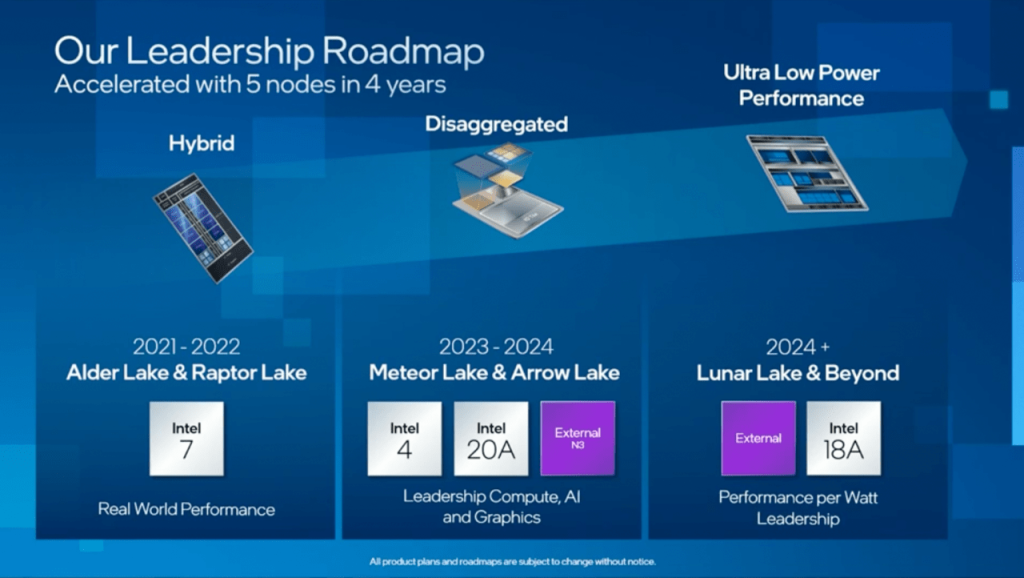

A little over a year ago I argued the company should be split up, but then Pat Gelsinger returned to Intel with a plan he called IDM 2.0. The vision was compelling: Intel would gain all of the benefits of a split while retaining the advantages of being a single company. The skepticism is about whether or not Intel can actually pull it off.

I got a chance to talk to Gelsinger earlier this week about IDM 2.0, the acquisition of Tower Semiconductor, and the choices Intel did not make.

As a reminder, the Daily Update Podcast is particularly useful for interviews, even if you are generally a reader.

On to the interview:

An Interview with Intel CEO Pat Gelsinger

This interview has been lightly edited for clarity.

Pat, it’s good to talk to you. I appreciate you taking the time. So last week, AMD briefly passed Intel in market value, and I think Nvidia did a while ago, and neither of these companies build their own chips. It’s kind of like an inverse of the Jerry Sanders quote about “Real men have fabs!” When you were contemplating your strategy for Intel as you came back, how much consideration was there about going the same path, becoming a fabless company and leaning into your design?

Pat Gelsinger: Let me give maybe three different answers to that question, and these become more intellectual as we go along. The first one was I wrote a strategy document for the board of directors and I said if you want to split the company in two, then you should hire a PE kind of guy to go do that, not me. My strategy is what’s become IDM 2.0 and I described it. So if you’re hiring me, that’s the strategy and 100% of the board asked me to be the CEO and supported the strategy I laid out, of which this is one of the pieces. So the first thing was all of that discussion happened before I took the job as the CEO, so there was no debate, no contemplation, et cetera, this is it.

Second is, so let’s seriously ponder that for a moment. Let’s ignore the fact that we’ve laid out the IDM 2.0 strategy and let’s use AMD as a case study for a moment. When did they sell their fabs?

Eleven years ago? Twelve years ago?

PG: 2008.

(laughing) Oh, man. Fourteen years ago!

PG: Okay. And then how many years was AMD a rocking success?

Really just the last couple.

PG: Last three years. So it took them eleven years to get over it at that level, so I’ll just say in this eleven years and when they spun it out, there was a significant commitment that what became GlobalFoundries would be their leading edge process technology provider.

Right. And GlobalFoundries bailed out.

PG: GlobalFoundries failed to stay current on the front end of technology in the process, and now, they’re clearly a tier-two mature node foundry for the industry, and doing well, but they had to redefine their business model because they couldn’t compete with TSMC or be part of the Big Three, I’ll call it Samsung, TSMC and Intel on leading edge. So their originally conceived strategy failed to split the company and have it become a leading edge provider to them, and even they had lawsuits between them to go clean up that mess because they couldn’t stay current and they had to essentially follow in the fumes, I will call it, of Apple making TSMC a viable leading edge foundry. And I could argue that if that hadn’t happened, we still wouldn’t have a leading edge, viable foundry in TSMC. Apple drove them to be successful with volumes, capacity, technology, et cetera, and they’ve obviously done a good job of it now as well.

Second is, the strategy as conceived when they broke it up was a failure. Today, AMD is a success as a fabless vendor but not because of the split, but because they were able to essentially create a second entity and go rely on TSMC, so I’ll say the proof point here of that kind of strategy is zero. They are a successful company now but not because of the split to become fabless at that point in time.

And then third, as we look at this, to me, there is almost a global national perspective to this, in that I deeply believe the West needs a world class technology provider, and I don’t think that splitting Intel in two, that it could survive for many, many, many years till that would become the case, that you could stand that up. Remember, given cash flows, R&D streams, products that enable us to drive that, and I’m committed to go fix it, and I think we’re on a good path to go fix it since I’ve been here as well. So for those three different reasons, we chose the IDM 2.0 path, but it’s not because we didn’t look at the alternative, it’s partially because we did.

I think you were more explicit than you’ve ever been in the Intel Investor Meeting about Intel’s geopolitical importance, and you just restated that right now and obviously that plays a role in getting things like the CHIPS for America Act passed and things along those lines, but I’m curious how much of a role it has played in talent acquisition? I think the speed with which you’ve overhauled a lot of Intel’s management has been very impressive to me, and in the big picture, how much does that play into the pitch versus the “Hey, a lot of folks come back to Intel” or view the chance to take on this challenge, how much though is the patriotic angle, for lack of a better word, go into that?

PG: It’s an angle, but most engineers show up because of the cool stuff they work on. That’s part of why we are here, but if you would ask Dave Zinsner, my CFO, this is on his list. If you would ask Christy [Pambianchi], my Head of People, this is on her list as well. Even a guy like Nick [McKeown], he’s here to change networking, but this is on his list, so I’ll say it’s a factor. It’s not the top of the list but it’s on the list of why people are coming back, and so many of the comments, Ben, that I’ve gotten from people — sometimes it pisses me off that the stock is down, the investors are negative and everybody is cheering us on. “Oh, you’ve got to be successful, Pat!” “Well, buy my stock. (laughing) Put your freaking money where your mouth is if you’re going to say it”, but the enthusiasm for us to be successful couldn’t be higher, even in our skeptics I’ll say.

I notice that as well in the feedback I’ve gotten.

PG: Even the people who say that, “Hey, I’m not sure Pat can ever pull this off. I’m not sure, it’s dead money for two or three years,” and so on, “But oh, I sure hope he succeeds.”

Just to dive into the IDM 2.0 strategy, even if Intel is keeping manufacturing, and I wrote about this a few weeks ago, it does seem apparent to me that a kind of de facto split has happened internally.

PG: Yeah.

Including the fact Intel’s outsourcing more and more to TSMC. In your investment presentation, there was one of your future architectures, the CPU chip was N3 which is TSMC nomenclature.

What’s interesting to me is that the dual benefits Intel gets from this, on one hand, you get the fastest process in the industry currently, on the other hand, Intel’s forced to adopt these industry standard tools and approaches, which Intel’s talked about before, but now you have no choice if you’re going to be modular. You can’t lean on integration and figuring out stuff in partnership with manufacturing, but that also feels like a really good wake up call for manufacturing because they can’t get the design team to bend to their will if it’s an external customer, and now they can’t get it to do it if it’s an internal customer either. Or is this too much searching for a silver lining in what is a bit of a suboptimal situation where you’re having to outsource and these sorts of things?

PG: No, it’s not. It is part of my conscious strategy, because I have one slide in my deck that says IDM makes IFS better and IFS makes IDM better.

This is one piece of that. Some of the things I said is, “Hey, IDM makes IFS better. Hey, it gets to inherit $10 billion of R&D for essentially free at that level”. Huge capital outlays, et cetera, are enabling IFS, but IFS makes IDM better as well for exactly the reasons you’re describing. I don’t have to benchmark my TD team, my IFS customers are doing that for me. Some of these conversations, Ben, I just find them delightful. We have these five whale customers that we’ve talked about, these are active conversations. Active, daily things and in that, the teams are now saying, well, what about the ultra low voltage threshold for the thin pitch library that we’re going to use in this particular cell? “TSMC is giving us these characteristics, you don’t characterize that corner.” Okay, guess what? Go characterize the corner! “Your PDK isn’t as robust as the Samsung or TSMC PDK is to describe the process technology for my team to simulate.” Well, guess what? You know, all of these things describe in conversations that make my TD team better, make my design teams more productive because they would’ve pushed on my TD team before to say, “Hey, we need that thin cell library at low voltage”, and they wouldn’t have gotten it.

Right.

PG: Because it wasn’t mainstreamed in the processor. It was sort of, “Hey, for some of these use cases over here”. Well, now they get it, and all these things are driving us to be better. So in some ways, in a not very subtle manner, I’ve unleashed market forces to break down some of the NIH of the Intel core development machine, and that is part of this IFS making IDM better.

Yeah, that makes a lot of sense. You had this uber-aggressive roadmap, five nodes in four years, and I have two questions on that. The first one goes back to something you mentioned before about Apple being a partner to TSMC in getting to that next node and how important that was for TSMC. I think I noted that in this new Tick-Tock strategy, Tick-Tock 2.0, Intel’s playing that role where either the tick or the tock is Intel pushing it and then the tock is opened up to your customers. I take it that’s an example of how Intel being the same company really benefits itself, that you get to play the Apple role that Apple did for TSMC, you just get to play it for yourself.

PG: Yeah, well stated. Now let’s say, because I’m expecting Intel 18A to be a really good foundry process technology — I’m not opposed to customers using 20A, but for the most part, the tick, that big honking change to the process technology, most customers don’t want to go through the pain of that on the front end. So usually my internal design teams drive those breakthrough painful early line kind of things, is very much like the Apple role that TSMC benefited from as well. Now, if Apple would show up and say, “Hey, I want to do something in 20A”, I’d say yes.

Come on in!

PG: If you list them, there are ten companies that can play that role — Qualcomm, Nvidia, AMD, MediaTek, Apple, that are really driving those front end design cycles as well, and if one of them wanted to do that on Intel 4, I’d do it, but I expect Intel 3 will be a better node for most of the foundry customers, like Intel 18A will be a better node for most of the foundry customers as well.

I think it’s just Apple, and I think that’s actually one of the powerful reasons for Intel to do this itself, and also frankly it’s beneficial for TSMC to have Intel onboard as well as a counterweight.

One other thing, is it kind of nice in a way to be in second place? You’ve really emphasized a ton about how you are learning from and benefiting from your suppliers in a way that Intel didn’t previously and I do want to dive into that a little bit more. Those suppliers have learned a lot from TSMC and from Samsung — how much of a role does your confidence that you can get learnings from your suppliers, drive your confidence that you can actually achieve this super aggressive rate of advancement?

PG: It’s a meaningful benefit. My team doesn’t like the idea of being second in the race, so they’re pretty passionate. We do believe at 18A we’re unquestionably back in the leadership role but getting EUV healthy on Intel 4, as an example, is very much benefited by the fact that TSMC and ASML have already driven that up the learning curves as well. I’m just asking ASML, “Are my layers per day on EUV, are they competitive?” Period. And if not, why not? I’d say we have very robust debates on those kind of questions now. “Well, they’re measuring it differently than we measure it” and “How do you measure downtime and maintenance windows and all that kind of stuff” and I’m like, “Hey, I don’t care. Just show me the fricking data.” And you know, I go to Peter [Wennink] and Martin [van den Brink] at ASML and ask “How are we doing”? Or Gary [E. Dickerson] at Applied Materials and it just takes a lot of these things off the table, cracking open these doors just forces us to accelerate the competitiveness.

Yeah, I think getting Intel to drop the “They’re measuring it differently” excuses is a win in and of itself.

PG: (laughing)

Something that’s very interesting about Intel is that before now, because you didn’t have a foundry business, you couldn’t make a lot of money on old foundries which are already depreciated and producing stuff for almost pure profit. Instead Intel took a different strategy of reusing equipment and repurposing it for the next node, and that rolled back into the design because they had to accommodate using equipment longer, et cetera, and I think from my perspective was one of the reasons why Intel ran into a wall, because they weren’t cutting edge because they were dragging along lots of old equipment.

My question is when you look back at running into the wall, and obviously there are lots of factors that went into that, but do you think it’s even possible to be an IDM-only anymore in the way Intel was? Or is it just so difficult now to be on the cutting edge that you really need to start fresh every time? Which means, to be profitable, you need all the past processes to stay in use much longer, which by definition is a foundry business. Leaving aside everything else, the delay on EUV, all those sorts of things, is it even possible to do the old Intel strategy any longer?

PG: Well, I think it’s possible. I think had Intel not screwed up on 14 to 10, I think they’d still be doing fine, and we wouldn’t have been in such a catatonic state of crisis. Now that said, there’s a better business model in front of us and we’re going to seize it. I do think we made some bad equipment choices because we were reusing where we should have been embracing new. Had we had a natural exhaust path for those processes and equipment choices I think we would’ve been less encumbered on the front end, so I do think that hurt us in that regard. I do think this idea of minimizing equipment turnover, by trying rolling from what you know was 17 to 14 to 10, became somewhat problematic for the company. “We know how to make this tool work and we know how to go do quad patterning, so we don’t need that crazy EUV stuff”, some of those kind of things. But you know, I don’t think fundamentally the business model was broken. Intel failed to keep executing it well and part of that was driven by some of these insular natures.

The first time I met [TSMC CEO] C. C. [Wei], he said, “Pat, you really piss me off. You make money on the front end of technology.”

(laughing) Right, yeah.

PG: And I said, “C.C., you piss me off. You make money on the back end of technology!” So by the way, we’re now doing both. Both of us are now doing both. With TSMC’s major price increases on front-end nodes, he’s now pricing such that he’s making money on the front-end, which he didn’t used to do, and with my adding a foundry on the backend, I’m making money on the back-end nodes going forward. So to some degree, we’re both modifying our business model going forward. By the way, this is such a big, expensive business, it’s appropriate in both directions.

The Tower acquisition makes all kinds of sense to me in that Intel didn’t need to just flesh out its portfolio of offerings that it had as a foundry, particularly in analog, but also needs to build out the capability of servicing external customers. This is a reason why I was cheering for an Intel GlobalFoundries tie-up at some point. Obviously, they don’t have leading edge, but to your point, they’ve spent 14 years figuring out how to service external customers and building the IP around that, all those sorts of things. Tower does address some of those needs, my concern though is it’s much smaller in comparison to Intel, so how do you capture the parts of the customer service bit that you need without it being squashed by the Intel culture?

PG: Is Tower being merged into Intel Foundry or is Intel Foundry being merged into Tower?

Right.

PG: The answer is more the latter than the former. I’ve said I fully want to merge these businesses together going forward, and that doesn’t mean this is a little satellite under this thing that we’re getting started in IFS. We’re going to bring those together, and I fully expect that the outcome is a fully integrated business unit that heavily leverages the five thousand people in Tower. Its thirty years old, Israeli-centered, and we know a lot about having good Israeli discipline as part of our team.

The other thing I’ve said is that, “Hey, I’d like to do a Mobileye-like spin on our foundry business at some point as well.” I’m going to keep the structure, as opposed to integrating as much, I’m going to keep it more separate to enable that, which means I’m going to leverage a lot more of Tower and the expertise that it builds over time as part of it.

It was also interesting the contrast with GlobalFoundries, and I mean, I was interested in exploring GF. When we looked at Tower, it became apparent that there was a more natural fit here than first meets the eye. One of them is, “Hey, that would’ve cost me $30 billion, this will cost me $5.5 billion —”

You need money to build fabs.

PG: When I’m capitalizing at the rate I am capitalizing $25 billion matters, so that’s important.

But the second is that I create a natural outtake to be in the mature nodes as time progresses. It’s not like I need GlobalFoundries to help create 16 nanometer technology, I’m going to have tons of that going forward, and 10 nanometer. So Global needs to keep moving forward, but they hit a wall at 10 nanometers, because they can’t afford to leap over EUV, so their business naturally gets compressed between customers needing to keep moving forward and hitting the 10 nanometer wall, which I easily solve for it. So to some degree, they have a degrading value asset that’s more expensive. Whereas the specialty technologies will be here forever and ever doing our RF technologies, et cetera, and all the nodes there. They are actually more sustainable and sticky over time to be scaled up, whereas I’ll say the mature nodes have natural pressure.

The other thing that happens in the marketplace is that China is pouring extraordinary capital into their semiconductor business. They can’t be below 10 [because they can’t get EUV], and the specialty nodes are hard for them to replicate. Where does it go? It goes into memories or it goes into mature nodes. I see that business as we looked at that a whole lot more carefully and you look at where the GF value proposition is right now, it’s like “Man, this gets to be, it’s a very good position to be in ’22 and ’23. But ’24, ’25, ’26, hmm.”

So if I can get that DNA from Tower and make sure I keep it alive and healthy and prepare for the complement that I have Intel and specialty, I never want to be in memory, you see I’m doing everything I can to exit our memory businesses in that regard.

(laughing) You don’t want to undo Andy Grove’s most famous decision, right?

PG: Yeah, right. It naturally fills the mature node space over time as a result of my leading edge capacity becoming mature and depreciated over time. So I think I actually end up in a much, much better place as a result of the Tower acquisition.

I am curious about this mature node question. Intel was actually building 14 or 16 nanometer years after they’d already pioneered it because of the wall they hit with 10, so you’re going to have plenty of capacity there, but when it comes to like 28 to 45, I mean, you don’t really have any because you rolled that all forward. Should Intel have done this shift previously? Because those are the nodes where there’s just tons of activity going on. Are you a little too late or is it just in time?

PG: It’s a good question, because would I like to have some 28 nanometer capacity to compete with? Yeah, I would, to be more effective in the foundry business. But what’s happening, Ben, and I think a well-executed Intel 16, because why would a customer put a new design start on 28 when they could choose 16?

You’re going to have tons of capacity to and you can have a lot of pricing power and things like that.

PG: Now, if I were a TSMC customer today, that’s a sweet spot node for TSMC, and so 28 is really good. If you have stuff older than that, you’re going to be moving those designs forward as a result of the whole semiconductor shortage. And I think I’d say, “Hey, move all the way. Move to 16 or move to the last great FinFET technology 3.” There are different price points per transistor and performance and densities and so on, but if you’re moving your design, I think we actually have a pretty good choice. We’re going to be auto grade on both 3 and 16 as well. So I think I can compete fairly well if you’re moving the design. If you’re on an existing node, then what I really need to do is go be essentially process compatible with 28 from TSMC. So for that, I wish I had that, but I’m not sure it’s worth $30 billion to go get it. If I think I can get the DNA and I have a lot more specialty technologies that are going to keep scaling for a long time into the future, I think we’ve gotten a much better asset than a GF deal would’ve looked like because of some of these broader factors.

Stepping back, a critical piece of making this strategy work is the secular bet that computing is going to significantly increase. TSMC has obviously made the same bet and their capital expenditures are stratospheric. Right now we see this chip shortage, it’s very acute, but at the same time, IFS isn’t going to reach scale for several years. Are you worried that we’re going to have a situation where all this TSMC capacity comes online, IFS comes online, Samsung comes online — this is classic in the semiconductor industry — that there’s suddenly way too much capacity? Are you worried about a slump in that case?

PG: I’m not really, but let’s tease it apart a little bit more, Ben, while I sit here. The first thing I’d ask you, because there is a cyclical nature to the semi industry, when was the last time we had a logic surplus, not a memory surplus?

I don’t know.

PG: The last memory surplus was about three and a half years ago. The last logic surplus was over a decade ago. So, this idea, as I asserted at the investor event, was there’s an insatiable demand for computing and high performance.

You had smartphone though over the last decade though; going forward it’s all high performance, machine learning, that’s where you see all the demand coming from.

PG: Yeah, I just could see I want my phone to be more powerful at lower power. I want my cloud to be more powerful at lower power, my car — we’ve talked about the automotive industry going from 4% of the BOM to 20% of the BOM by 2030. Where’s that bill of materials going in the auto semi? High performance connectivity, autonomous vehicle characteristics, which are hundreds of tops of performance requirement, advanced infotainment systems, and EV, the electrification of the vehicle, which is largely specialty nodes at that point. None of it’s going into mature nodes, all of it’s going into advanced computing. As we tear that apart, we’re not all that worried.

Now, let’s look at the capital expenditures. Only three companies get to go below 10 at scale. Samsung, TSMC, and Intel. Obviously, Samsung’s capital budget is clearly going to be carved up between memory, taking the majority of it, and logic. My budget is not going to be carved up between memory and logic, it’s all about logic. TSMC’s capacity is carved up between mature — they’re now having to go can reinvest the mature nodes —

They’re also building mature nodes, yup.

PG: And leading nodes, so I think in that picture, as we’ve looked at it, we’re sort of okay, and we have the trump card, a Western foundry. People are going to be less and less comfortable for, Korea versus Taiwan versus Ohio versus Taiwan. Where are you going to put your second source and your second capacity? We’re going to announce our European expansion shortly as well, there is a bias for a Western foundry capacity. I think inside of that, we are okay as we look at that.

Obviously, we’ve got a lot of work to do, these things take time to build up, but when the pressure comes, I think I’m well-positioned.

And the other point I’ve made there is let’s imagine I have an extra fab, just sitting here, filled with the EUV equipment, ready to build wafers in 2026. I can use that one of three ways. One is I go win back more share from AMD. Hey, maybe I do it at lower margin points, but I’m okay with that. Second, I go win more foundry business, take it at lower margin points, but go win more foundry, or third, I pull chips back from my external foundries back into my own fabs. All of them are very cash accretive to the company, any of those three strategies. So, I lust for the day that I’d have a spare fab, cause I think it means market share and improved margins for the company.

Is x86 still a trump card, or is that fading?

PG: Hey, I got a 486 on my wall here. It’s not like I’m shy of having a sentimental bias here, but at the same time, an architectural franchise, one, isn’t what it used to be in the sense that there’s RISC-V, ARM, x86. There’s a broadening family of accelerators that run more meaningful workloads. You can’t be as simplistic and just say if it ain’t x86, it ain’t good, and that’s why we’re supporting RISC-V, ARM, and x86.

At the same time, the long tail of a software ecosystem is still a very powerful long tail. Every day I sell another x86 socket, that is the highest margin, most strategic thing that Intel can do. So I’m going to be far less biased on supporting other architectures, GPUs, et cetera, in that regard, with oneAPI to all tie it all together, but the x86 franchise is still alive and very well. In terms of compute workloads, if you do the holistic view, as fast as Nvidia has increased GPU workloads versus this much, much larger base of x86 workloads, it’s not clear that the x86 workloads haven’t continued to increase as a percentage of the whole over this period of time.

That’s very interesting. Well, I snuck in one extra question, but I feel like I could have ten more, but I really appreciate you taking the time to chat and I will say it, as an American living in Taiwan, I can feel that sentiment as well. So, it’s going to be very fascinating to watch. I don’t buy stocks of individual companies, so you can’t look at me with that look on your face, but thank you for taking the time. It’s very interesting.

PG: Absolutely, I appreciate the conversation, Ben. Thank you.

This Daily Update Interview is also available as a podcast. To receive it in your podcast player, visit Stratechery.

The Daily Update is intended for a single recipient, but occasional forwarding is totally fine! If you would like to order multiple subscriptions for your team with a group discount (minimum 5), please contact me directly.

Thanks for being a supporter, and have a great day!

Share Facebook

So you have finished reading the interview intel pat gelsinger idm tsmc topic article, if you find this article useful, please share it. Thank you very much. See more: intel pat gelsinger announcement, stratechery, intel foundry capacity, intel expansion, stratechery passport, intel external manufacturing, intel foundry services, intel future plans